Blockchain tokenization transforms orbital assets into auditable, investment-ready instruments for aerospace markets

Aerospace finance has long been the domain of sovereign budgets, defense contractors, and multinational institutions. But as space becomes an increasingly commercial frontier, traditional funding models are struggling to keep pace with the scale and velocity of modern innovation.

Today, tokenization is redefining how capital is deployed into orbit. By transforming physical assets—such as satellites, launch infrastructure, and orbital platforms—into digital tokens on blockchain networks, institutional and sovereign investors are gaining access to transparent, programmable, and globally accessible financing mechanisms.

These blockchain-based models promise not only efficiency but also entirely new categories of investment-grade instruments that blend aerospace development with digital finance.

Content

Why Space Infrastructure Needs Tokenization

The global space economy is expected to exceed $1.8 trillion by 2035, driven by advancements in satellite internet, Earth observation, and defense technologies. Yet, financing remains complex. Each satellite project involves thousands of components, multiple contractors, cross-border regulatory oversight, and years of capital lock-up.

Traditional models—structured debt, government grants, and limited equity participation—lack the liquidity and transparency that global investors increasingly demand.

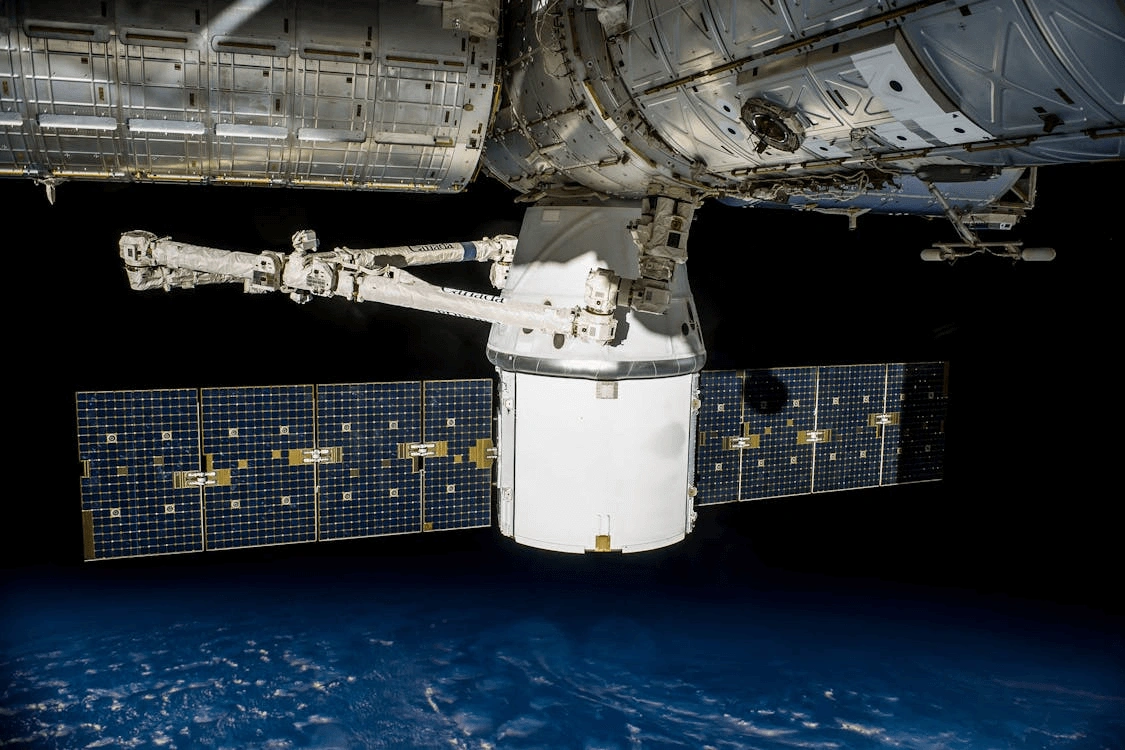

Tokenization introduces a new paradigm. Through blockchain-based asset registries, a satellite or launch vehicle can be fractionalized into verifiable digital tokens. These tokens represent proportional ownership or usage rights, streamlining syndication between investors, insurers, and operators.

Smart contracts can automate milestones—such as payments upon successful deployment—reducing administrative overhead and minimizing counterparty risk.

For governments, this structure allows greater collaboration with private entities. For institutions, it opens a route to participate in one of the fastest-growing sectors of infrastructure finance—without the opacity that has historically surrounded aerospace projects.

Satellites as Tokenized Assets

Satellite networks represent the backbone of the digital economy, powering GPS, communications, weather forecasting, and global connectivity. As the number of deployed satellites exceeds 9,000 active units, the associated capital intensity has drawn significant institutional attention.

By tokenizing satellite ownership or bandwidth allocation, developers can raise capital more dynamically. Investors purchasing these tokens gain exposure to potential yield streams from data licensing or transponder leasing—mechanisms that can be governed and distributed through blockchain-based settlement systems.

Moreover, tokenization enhances auditability. Satellite operational data—such as transmission logs or orbital telemetry—can be linked to distributed ledgers, providing verifiable performance metrics to stakeholders. This combination of real-world data and immutable digital representation lays the groundwork for a new class of space-linked financial products.

Launch Pads and Supply Chains on Chain

Beyond the satellites themselves, the infrastructure required to reach orbit—launch pads, manufacturing hubs, and ground stations—presents another layer of opportunity. Tokenized financing models allow aerospace contractors and facility operators to access decentralized capital pools without diluting ownership or relying solely on government subsidies.

For instance, launch service providers can tokenize usage rights to future missions, allowing institutions to pre-fund capacity in exchange for on-chain settlement guarantees. Each token acts as a verifiable claim, automatically recognized across a consortium of insurers, suppliers, and logistics providers.

Such systems dramatically reduce reconciliation delays that typically plague complex aerospace projects. Through smart contracts, payments, insurance disbursements, and component verification can occur in real time, minimizing the cost of oversight and increasing confidence among participants.

Orbital Assets and Data Marketplaces

The emerging category of “orbital assets”—including space stations, debris management systems, and data relay networks—introduces yet another layer of tokenization potential. These systems generate continuous data flows that can be monetized across defense, agriculture, and climate monitoring sectors.

Blockchain platforms can transform these data rights into tradable digital instruments, with automated access permissions embedded directly within smart contracts. This allows institutional buyers, such as research organizations or logistics firms, to purchase satellite data streams securely and transparently.

Furthermore, tokenized data rights provide a secondary market for institutional investors seeking exposure to the informational economy of orbit—where data itself becomes the yield-generating asset.

Sovereign and Institutional Experimentation

Several national agencies and institutional players are already exploring blockchain integration within aerospace finance. Sovereign wealth funds and export credit agencies are assessing how distributed ledgers can enhance transparency across supply chains and improve capital allocation efficiency.

Tokenized debt instruments tied to satellite or launch projects are being piloted to facilitate co-investment across jurisdictions. The use of blockchain ensures that every funding tranche, subcontractor milestone, and compliance verification is recorded immutably—creating an auditable digital twin of the project’s financial structure.

This shift is particularly attractive for defense-related programs that require multi-agency collaboration while maintaining strict data integrity. By embedding programmable compliance directly into funding rails, blockchain-based systems enable simultaneous privacy and accountability.

Challenges in Space Tokenization

Despite its potential, tokenizing space infrastructure faces several regulatory and technical hurdles. Jurisdictional ambiguity around asset ownership in orbit remains unresolved under existing international treaties. Additionally, harmonizing financial regulations across national borders is essential to ensure that tokenized instruments are legally recognized.

Cybersecurity and data integrity are also paramount. Since space missions involve critical national and commercial assets, tokenized systems must integrate advanced encryption and real-time monitoring to prevent unauthorized access or manipulation.

Moreover, while blockchain technology offers immutable recordkeeping, scalability and interoperability between institutional systems remain ongoing challenges. Progress is being made through hybrid models where private and permissioned blockchains integrate with traditional aerospace financing networks.

The Emerging Asset Class in Aerospace Finance

Tokenized space infrastructure is not a speculative experiment—it represents a structural evolution in how capital formation occurs for high-value, high-risk industries. The ability to issue programmable, auditable, and liquid representations of satellite projects or launch assets fundamentally transforms investor access and operational efficiency.

By combining aerospace innovation with blockchain transparency, institutional players are building the foundation for a new digital asset class—one that merges physical engineering with cryptographic finance.

As space becomes the next economic frontier, blockchain’s capacity for secure recordkeeping, automated compliance, and global participation will shape how humanity funds its ambitions beyond Earth.

Insight for the Digital Frontier

Kenson Investments provides in-depth market insights into the intersection of digital assets, institutional infrastructure, and emerging blockchain technologies. The digital asset management consultancy offers educational resources exploring how tokenized systems, decentralized settlement models, and compliance automation are transforming the financial landscape.

Learn how blockchain innovation is reshaping infrastructure, risk management, and asset issuance across industries. Register now to stay informed about the technologies shaping tomorrow’s institutional finance.

Disclaimer: The information provided on this page is for educational and informational purposes only and should not be construed as financial advice. Crypto currency assets involve inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making investment decisions.

“The crypto currency and digital asset space is an emerging asset class that has not yet been regulated by the SEC and the US Federal Government. None of the information provided by Kenson LLC should be considered as financial investment advice. Please consult your Registered Financial Advisor for guidance. Kenson LLC does not offer any products regulated by the SEC, including equities, registered securities, ETFs, stocks, bonds, or equivalents.”

Jeremy is a crypto blog author who has been in the blockchain industry for 3 years. He loves to read and write about cryptocurrencies, blockchain technology, and cryptocurrency news. He is also an avid trader of various digital assets such as bitcoin and other altcoins on various exchanges including Binance, Bitfinex, Kraken, Kucoin etc.